"It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes. Distinctions in society will always exist under every just government. Equality of talents, of education, or of wealth can not be produced by human institutions.

In the full enjoyment of the gifts of Heaven and the fruits of superior industry, economy, and virtue, every man is equally entitled to protection by law; but when the laws undertake to add to these natural and just advantages artificial distinctions, to grant titles, gratuities, and exclusive privileges, to make the rich richer and the potent more powerful, the humble members of society — the farmers, mechanics, and laborers — who have neither the time nor the means of securing like favors to themselves, have a right to complain of the injustice of their government.

There are no necessary evils in government. Its evils exist only in its abuses."

Andrew Jackson, Veto of the Second Bank of the United States

"Unfortunately, however, trust is becoming yet another casualty of our country’s staggering inequality: As the gap between Americans widens, the bonds that hold society together weaken. So, too, as more and more people lose faith in a system that seems inexorably stacked against them, and the 1 percent ascend to ever more distant heights, this vital element of our institutions and our way of life is eroding."

Joseph Stiglitz, In No One We Trust

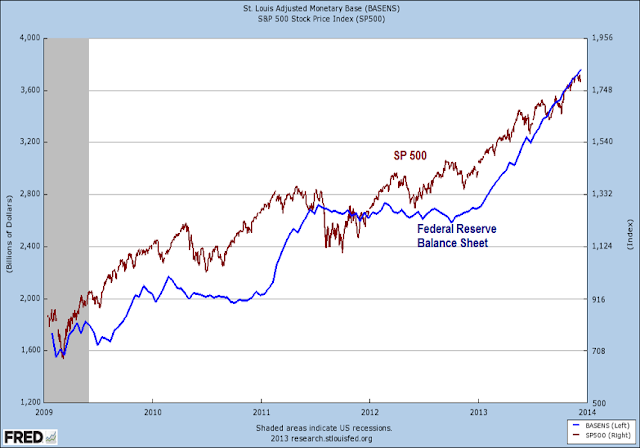

As you may recall I remarked on this apparent financial asset bubble policy by the Fed earlier this week here.

What many do not realize is that by printing money and directing it to the inflation of financial assets in a manner favorable to the Banks and the one percent, the Fed and the government are taking from almost everyone, including all holders of US dollars abroad, and redistributing it for the benefits of a few.

This is trickle down economics, and crony capitalism at its worst. And it will be covered up and denied by the usual suspects until the eve of the next financial crisis. And then, like bank bailouts, they will attempt to make the people another offer that they cannot refuse.

PBS Drops a Bombshell on the Federal Reserve’s 100th Birthday Party

By Pam Martens

December 22, 2013

PBS promised a “debate” this past Friday night on the “benefits and dangers” of the Federal Reserve as the Fed marks its 100 years of existence tomorrow. Instead of a debate, two famous stock market historians made the same stunning announcement – that the Fed has decided its job is to push up the stock market.

Consuela Mack’s Wealthtrack program on PBS had invited James Grant, Editor and Founder of Grant’s Interest Rate Observer, and Richard Sylla, the Henry Kaufman Professor of the History of Financial Institutions and Markets at NYU’s Stern School of Business. The opening scene for the program shows Sylla in a party hat lighting the candles on the Fed’s birthday cake while Grant snuffs them out – suggesting that Sylla would be making pro-Fed statements while Grant would take the opposing view.

What happened during the program, however, was that both men made the candid and bold accusation that the Federal Reserve, for the first time in its history, has assigned itself the job of propping up the stock market.

Grant had this to say: “New thing – it is in the business of talking up the stock market…The Fed is manipulating prices, especially on Wall Street.” To another question from Mack, Grant says: “The Fed has presided over the decay of finance.”

Professor Sylla adds more fuel to the fire, stating: “The Fed seems to have, I think almost deliberately, is trying to push the stock market up. I’ve watched this stuff for 40, 50 years now and this is the first time in my memory when it seemed to be official U.S. government policy that the stock market goes up. And the Fed likes this because it thinks that when the stock market goes up, people who own stocks feel richer, they’ll go out and spend more money, and the unemployment rate will come down.”...

Read the entire article with a link to the original video here.